In the wake of Didi Chuxing’s acquisition of Uber China, CB Insights analyses how the deal adds another level of complexity to the tangled webs of investment in the ride-hailing space. The fierce battle for ride-hailing supremacy in the world’s most populous market saw the two giants Uber and Didi Chuxing raise unprecedented amounts of funding as they rose to stratospheric valuations.

Uber’s China unit entered the fray in 2014, and since then both companies have spent billions on driver and rider subsidies to fight for every point of market share. However, that has come to an abrupt end with the sudden deal for Didi Chuxing to acquire Uber’s China arm.

Pending regulatory approval, the deal will see Didi assume control of Uber’s China operations and brand while it integrates the technology behind the scenes. Some headlines have painted this simply as a surrender for Uber and another in a long string of US tech company retreats from the Chinese market.

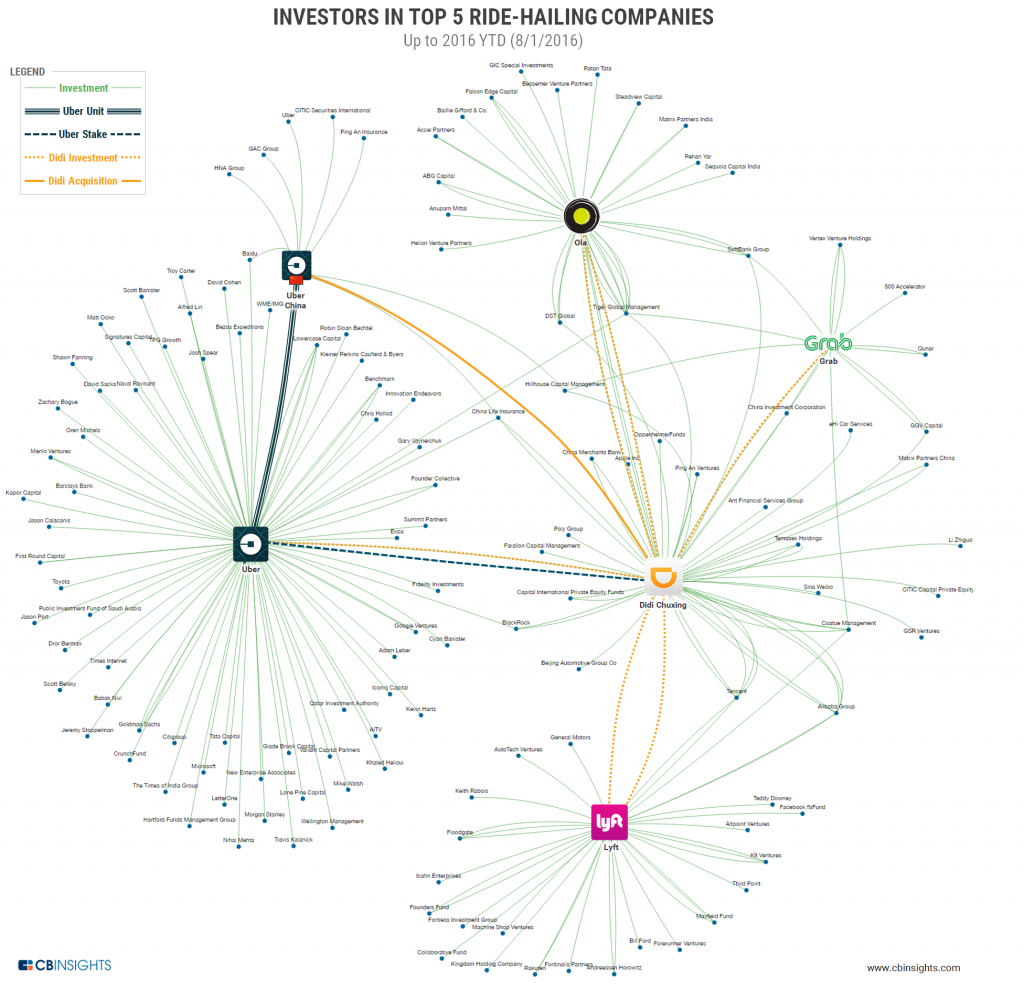

However, using the CB Insights Business Social Graph, which maps relationships between investors and target companies, we can visualize how the true outcome is more complicated than that. To begin with, the deal also saw Uber take a significant stake in Didi, and Uber itself also receive an investment from Didi Chuxing. We mapped out the investor networks of the 5 most well-capitalized private ride-hailing companies, including Uber and Didi Chuxing, as well as Lyft, Ola, and Grab, who were not directly involved but will undoubtedly see repercussions from the deal as they each have ties to Didi Chuxing. Note: Didi Chuxing’s graph also includes the backers of its pre-merger constituents, Kuaidi Dache and Didi Dache. The 5 ride-hailing startups are highlighted with their logos, and investments from one to another are highlighted in bolded lines according to the legend.

We used this social graph and the CB Insights database to pull further insights on the data:

- Uber retreats from China, but not empty-handed: In roughly two years in the Chinese market, by most accounts Uber burned about $2B in capital on its aggressive promotional strategy. Ultimately, the terms of the acquisition have Uber and Uber China’s investors retaining 20% of the post-merger Didi, with Uber effectively holding 17.7% (from a 5.89% preferred interest with voting rights) and Baidu and other Uber China shareholders receiving 2.3% between them. Uber China has been reported as having up to a $8B valuation, which would place Didi’s new valuation at $36B. Uber is now the largest shareholder in this combined entity, which makes for no small consolation prize.

- Didi has now invested in every other top 5 global ride-hailing company: As part of the deal, Didi Chuxing also invested $1B into Uber at a $68B valuation. Didi’s previous initiative to build a global “anti-Uber” coalition saw it inject capital into each of the other top ride-hailing companies, including India’s Ola, Singapore’s Grab, and Uber’s American rival Lyft. The alliance included plans for airline codesharing-esque features; for example, Didi’s customers can use their native app to hail Lyft rides while in the US (though matching functionality for Lyft in China had not been rolled out as of yet).

- The three other players (Lyft, Ola, and Grab) are now left in an uncertain position: Of course, the deal between the two largest companies now throws into question Didi’s relationship with its other “anti-Uber” partners, although news has quickly followed that Didi will be joining SoftBank to inject fresh funding into Grab. Nevertheless, the China detente between Uber and its most well-capitalized rival will still free up significant resources and focus for Uber to redirect against the other players. Last July, Uber promised to invest $1B in Ola’s home turf of India, while domestic competitor Lyft always remains in its sights. Lyft, of course, was said to have hired Qatalyst Partners to explore a sale last month. As an ironic footnote, Uber’s new Didi stake gives it an indirect position in each of its regional opponents.

- Investor webs are now even more tangled: Besides the companies themselves, our Business Social Graph also shows how complicated the picture has become for the investors backing them, from VC firms to hedge funds and corporations. For one thing, Didi Chuxing (including all of its pre-merger constituents) has now been backed by each of the Chinese big three internet companies — Alibaba, Tencent, and Baidu. The cross-pollinations in the space fostered by Didi have also made many investors indirect backers of rival ride-hailing companies. This includes investors like Coatue Management, which had originally backed ex-Uber challengers in Didi Chuxing, Lyft, and Grab. Interestingly, Apple, which backed Didi in May to the tune of $1B, now has an indirect link to Uber as well.

- Other investors with multiple stakes: Tiger Global Management has invested heavily in Ola, but has now also invested in Uber, Didi Chuxing, and Grab. SoftBank has invested in each of the three leading Asian companies (Didi, Ola, and Grab). Meanwhile, Hillhouse Capital committed heavily to China by backing both Didi and Uber China, but has also participated in a round to Grab. Chinese internet rivals Tencent and Alibaba have common interests in both Didi and Lyft.Is business travel giving duty of care the finger? Don’t travel managers care?

-GIF.gif)